Dear Friends,

For 24 years, and more intensively in the decade since the financial crisis, HOPE has concentrated its resources on closing the financial service gaps that limit opportunity for people and places existing on the precarious fringe of America’s economy. Roughly one in four, or 33.5 million, of the nation’s households either have no formal relationship with a financial institution, or look outside the banking system for credit and other financial services. The vast majority of these people are low income. Half of households making less than $15,000 a year and more than a third of those making between $15,000 and $30,000 a year are either unbanked or underbanked.

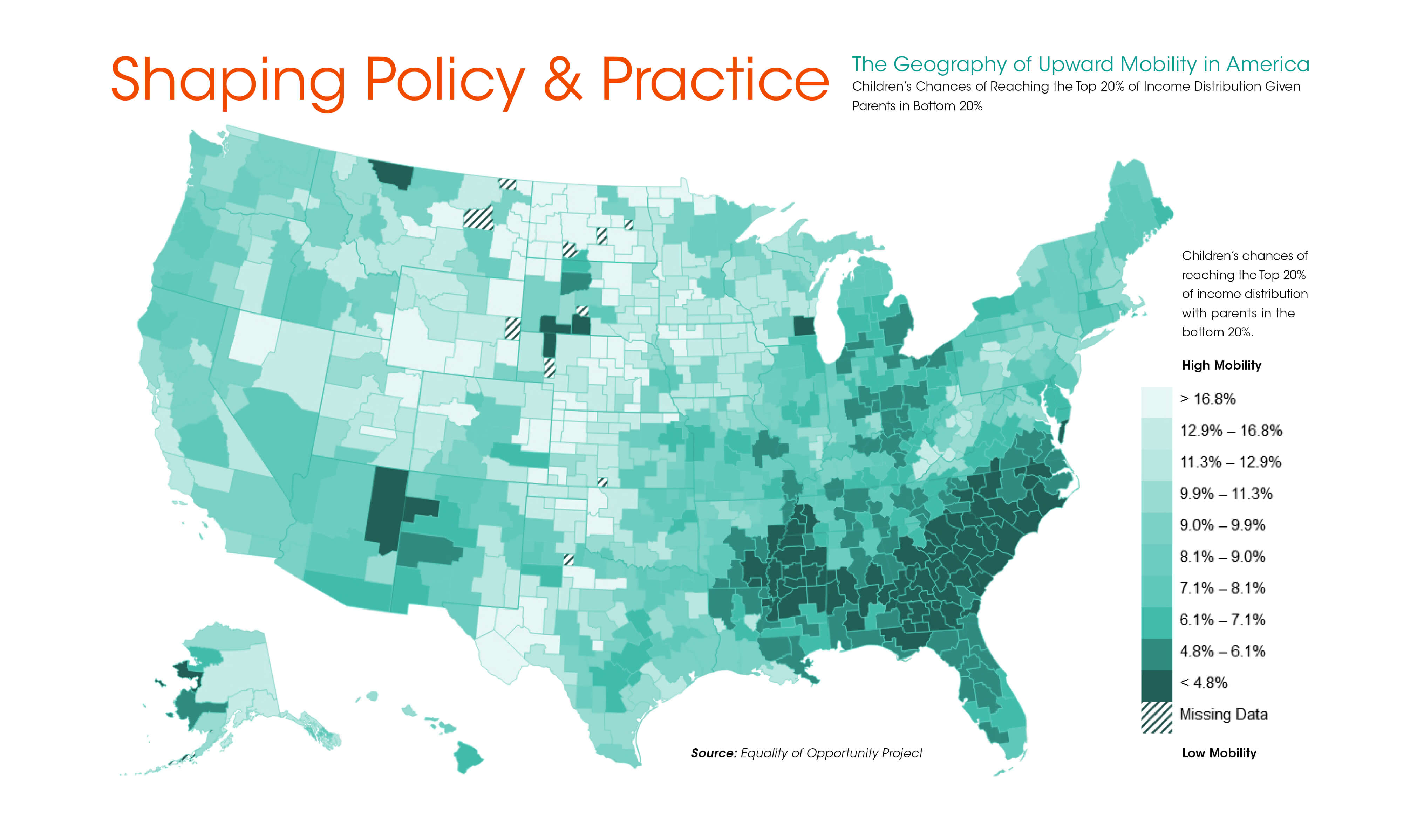

Entire communities are deprived of access to quality financial services. For example, the 50 most economically mobile counties in the United States have significantly higher rates of access to bank branches, conventional mortgage lending, and small business capital.